Growth-minded Accounting

Service for Your Company

Why maintain an accounting department within your company when BeanLab is capable and prepared to do it for you? BeanLab is backed by years of experience and definitive successes. Our team of seasoned professionals is determined to serve you loyally and consistently grow your organization.

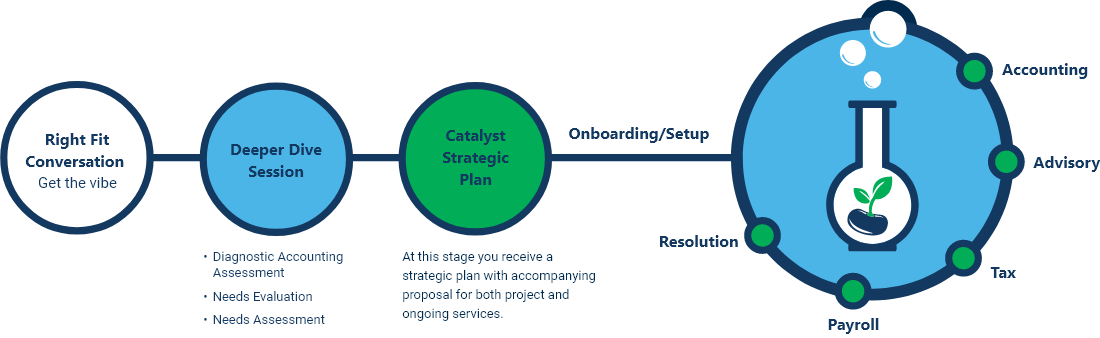

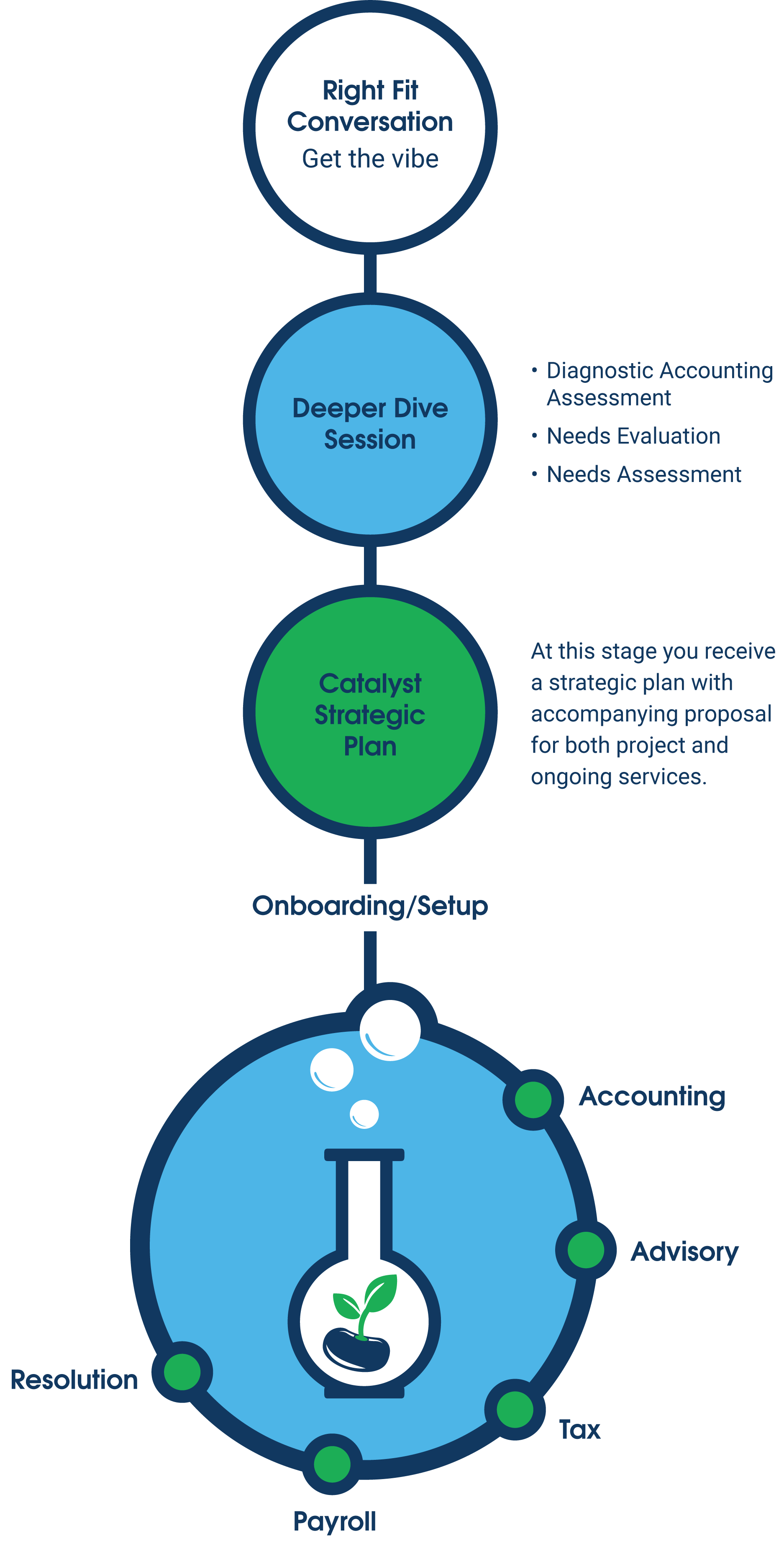

BeanLab’s Catalyst Process views accounting services holistically, with each individual service synergistically working alongside other services.

Why maintain an accounting department within your company when BeanLab is capable and prepared to do it for you? BeanLab is backed by years of experience and definitive successes. Our team of seasoned professionals is determined to serve you loyally and consistently grow your organization.

BeanLab’s Catalyst Process views accounting services holistically, with each individual service synergistically working alongside other services.

Accounting

Advisory

Payroll

Taxes

BeanLab is proud to offer strategic accounting & bookkeeping services focused on discovering opportunities for growth. Organizations nurturing long-term visions mature gracefully with year-round accounting partnerships. Learn More

The right advice can increase cash flow and profits, allowing your company the opportunity to map out growth strategies. BeanLab’s diagnostic accounting assessments lead to accounting solutions that ensure a legacy of success and profitability. Learn More

BeanLab’s payroll experience is on your side, ready to assist with payroll-related issues such as expanding into different states to employee participation in benefits. Learn More

BeanLab’s tax team becomes intimately familiar with each client’s business over the course of a year. Who better deal with annual tax preparation, sales tax filings, and quarterly tax estimates than the accounting professional assigned to your organization? Learn More

Grow Your

Business Right

Grow Your Business Right

BeanLab’s Catalyst Process

BeanLab’s Catalyst Process begins with a simple conversation about your organization. From there, we meticulously study your company’s financials and develop a detailed, attainable strategy for stable and secure business growth. The combined experience of BeanLab’s accounting team allows for the creation of an easy-to-follow map that will safely and legitimately bring your company into its next growth phase.

Our Ideal Partner:

- Is a business in the medical, creative, real estate, financial, or professional services industries.

- Has a long-term vision and a history of success.

- Is in need of a year-round accounting partnership.

- Desires to establish a respectable legacy and reputation.

- Wants sustainable business growth.

- Needs a trustworthy, knowledgeable, responsive accounting partner with specialized experience.

We at BeanLab know that running your business while simultaneously attempting to handle your books, payroll, and taxes is daunting. As your accounting partner, we will work alongside you while taking care of your accounting needs. You will also have the benefit of our knowledge, resources, and advice so you can make informed decisions.

The Numbers Don’t Lie